Introduction

Budget Buddy is designed to empower individuals in managing their personal finances effectively. Whether you’re looking to track your spending, create budgets, or set savings goals, Budget Buddy provides the tools you need to achieve financial stability and reach your goals.

Key Features

User Registration and Authentication:

Secure sign-up and login processes to ensure user data is protected. Users can create accounts and access their financial information safely.

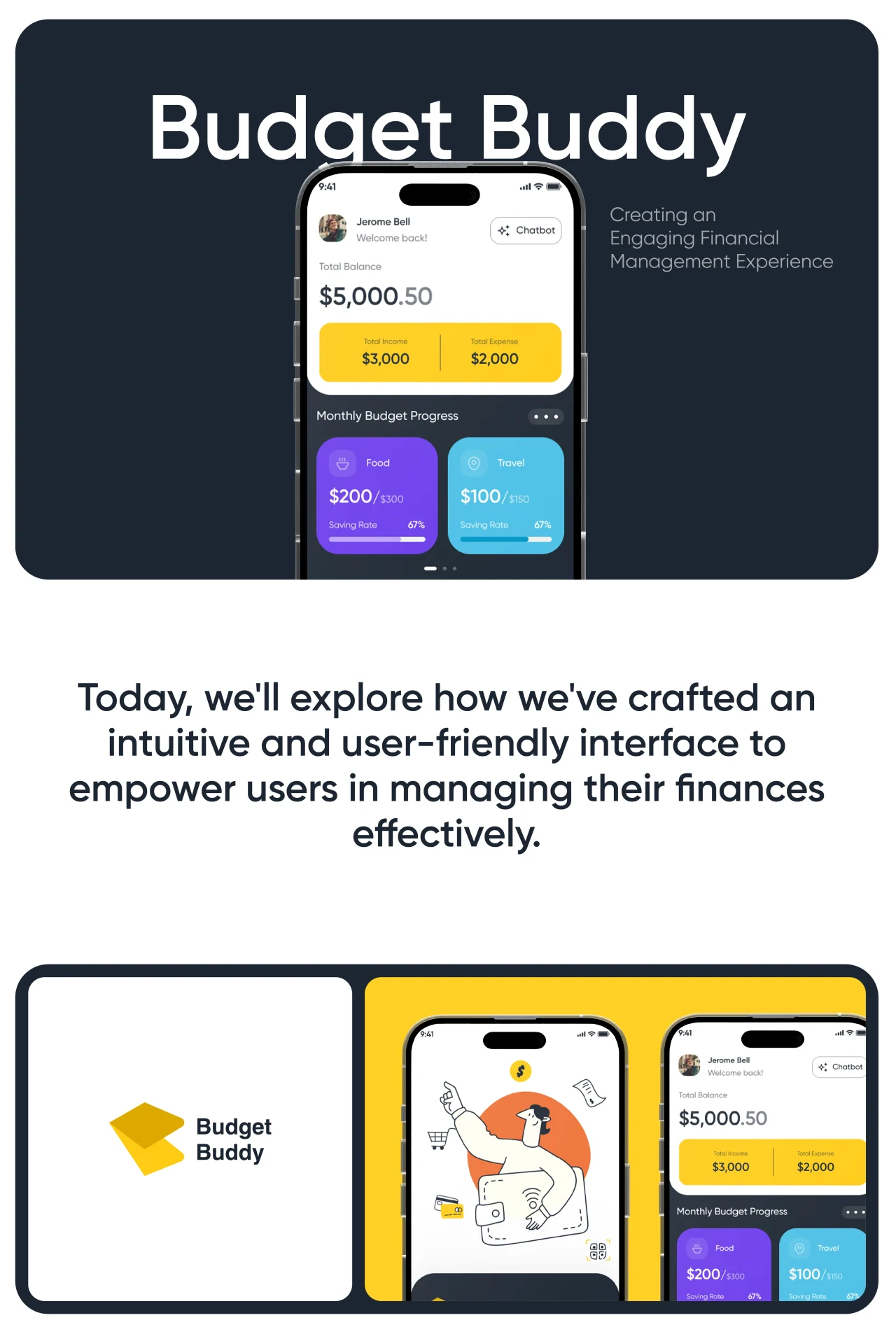

Dashboard Overview:

A user-friendly dashboard that provides a snapshot of financial health. It displays total income, expenses, and savings in an easily digestible format.

Expense Tracking:

Users can log daily expenses and categorize them (e.g., food, transportation, entertainment).

Budgeting Tools:

Create personalized budgets for different categories. Users can set spending limits and monitor progress throughout the month to avoid overspending.

Savings Goals:

Set specific savings targets (e.g., vacation, emergency fund) and track progress. Users can see how much they need to save each month to reach their goals.

Reports and Analytics:

Generate visual reports that illustrate spending patterns, budget adherence, and savings growth. This data helps users make informed financial decisions.

User Experience

Intuitive Interface: Budget Buddy features a clean, modern design that enhances user experience. Navigation is straightforward, ensuring users can easily find what they need.

Responsive Design: The app is accessible on various devices, including desktops, tablets, and smartphones, allowing users to manage their finances on the go.

Technology Stack

Backend: Powered by Node.js or Django for robust server-side functionality.

Database: Utilizes PostgreSQL or MongoDB to store user data securely.

Security Measures

Data Encryption: Protect user data with encryption protocols to ensure privacy and security.

Secure Authentication: Implement OAuth or similar methods for user login to prevent unauthorized access.

Deployment and Maintenance

Hosting: Deploy the application on reliable cloud platforms such as AWS or Heroku.

Domain Name: Register a domain to make the app easily accessible.

Regular Updates: Continuously improve the app based on user feedback and industry trends. Offer regular updates to enhance features and fix bugs.

Marketing Strategy

Social Media Engagement: Utilize platforms like Facebook, Instagram, and Twitter to promote Budget Buddy and share financial tips.

Content Marketing: Start a blog focused on personal finance education, offering valuable insights to attract users.

SEO Optimization: Enhance the app’s visibility through search engine optimization techniques.